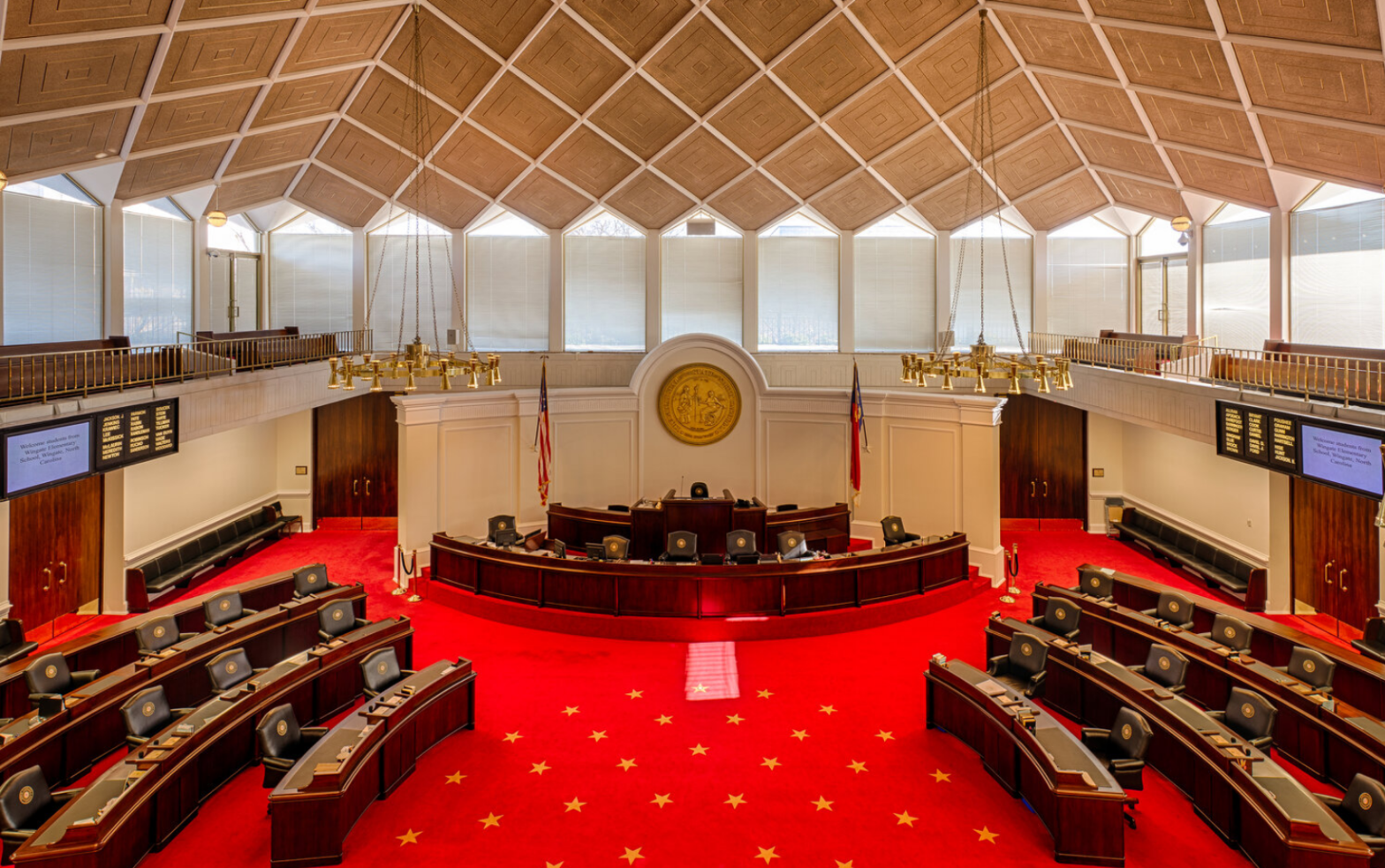

North Carolina House of

Representatives

FOR IMMEDIATE RELEASE Contact: Marshall Conrad

Date: February 16, 2021

NC House Members File Bill to Eliminate Tax on Military Retirement Pay

RALEIGH, N.C. – State Representatives John Szoka (R-Cumberland), John Bell (R-Wayne), John Bradford (RMecklenburg) and Diane Wheatley (R-Cumberland) filed House Bill 83 late yesterday to eliminate the income tax on

the retirement pay of military service members. “We want to make North Carolina the most veteran-friendly state in the nation and encourage our military members to stay in our state and move here upon retirement,” said Representative John Szoka. “Many other states provide tax relief for veterans, and with passage of this bill, we can make our state more competitive nationally.”

North Carolina is home to some of America’s most premier military bases, including the largest in the world, Fort Bragg. This bill would allow retired service members to deduct any retirement pay they receive from the federal

government. It would also allow survivors of service members to deduct any survivor benefits they received from the federal government.

“These men and women dedicated their lives to serving our nation, and this is a small but important sign of appreciation for their service and sacrifice,” said Representative Bell. “In North Carolina, we strive to be the

‘Nation’s Most Military Friendly State’ and this bill marks an important step in upholding our commitment and

support for those who serve.”

“I am proud to join my colleagues today in filing this bill to eliminate the income tax on military retirement pay,” said Representative Bradford. “This legislation shows our strong support for those who serve in uniform and retire in North Carolina. It is time we eliminate the tax on the pensions of military retirees, and I look forward to working with my colleagues to make sure this important bill becomes law.”

“Our armed forces retirees have sacrificed much for this country,” said Representative Wheatley. “As a Representative of Cumberland County, I know how strong our veteran community is in North Carolina.

This bill would provide tax relief to those who have spent their careers in service to this country and make North Carolina a destination for retired service men and women everywhere.

“With around 100,000 retired military service members in North Carolina and many more retiring across our nation each year, veteran recruitment is an essential component of developing North Carolina’s talented workforce,” said

Representative Szoka. “Our retired service men and women possess traits from their military training that are invaluable assets to the North Carolina’s labor force, and as a state, it is essential that we position ourselves to be a destination of choice after their service to our nation.”