August 13, 2021 Bill activity and movement is starting to return to normal at the legislature. One issue of significance to NCR and is part of our legislative policy agenda is dealing with Orphan Roads. NCR supports clear road standards and adoption procedures to ensure roads intended for Department of Transportation (DOT) adoption do not end up abandoned, leaving homeowners’ safety and financial security in jeopardy. House bill 489 was amended this week to include language requiring DOT to take over subdivision roads within 90 days of a request. This provision requires that the roads meet DOT’s standards for acceptance into the state road maintenance system. This is great news as it helps prevent subdivision roads from falling into disrepair while waiting for approval, and it ensures homeowners are not left with unexpected maintenance costs. House bill 489 passed all Senate Committees this week and will be heard by the full Senate the week of August 16. As the bill was changed in the Senate it will be sent back to the House for concurrence. NCR’s lobbying team is working to ensure concurrence in the House. Also this week, the House budget included $30,000,000 to be used towards bringing orphan roads up to DOT standards so they can be accepted into the state maintenance program. Many of the details need to be worked out so funding is for the 2022-23 budget year to give all stakeholders more time to determine the best way to allocate these funds. Other important budget provisions included in the House budget are as follows: Mill and Historic Tax Credits are made permanent The Historic Preservation Tax Credit program is essential to ensuring that our state’s historic properties are preserved and restored to their former glory for valuable use. These credits help restore downtowns and rural areas, helping to revitalize communities by generating economic development and tourism, bringing people to our state. NCR supports the continuation of historic preservation and restoration by eliminating the sunset of the Historic Preservation Tax Credit program. PPP aligns with the Federal Government This makes the requirements for those with PPP loans the same as federal guidelines. Increase in the standard deduction – the amount earned before taxes are collected. SALT (State and Local Tax Deductions) Provisions are included. Lowers personal and corporate tax rates Allocates $1 billion for broadband. Allocates $200,000,000 for the Housing Finance Agency to provide gap funding to get workforce and other affordable housing options completed around the state. Provides $30,000,000 for Travel and Tourism Marketing. Please stay tuned for future Advocates for updates on important budget provisions and NCR priority legislation. Copyright 2021 | NC REALTORS® 4511 Weybridge Lane, Greensboro, NC 27407 336.294.1415 | [email protected] | ncrealtors.org Update your subscription preferences. |

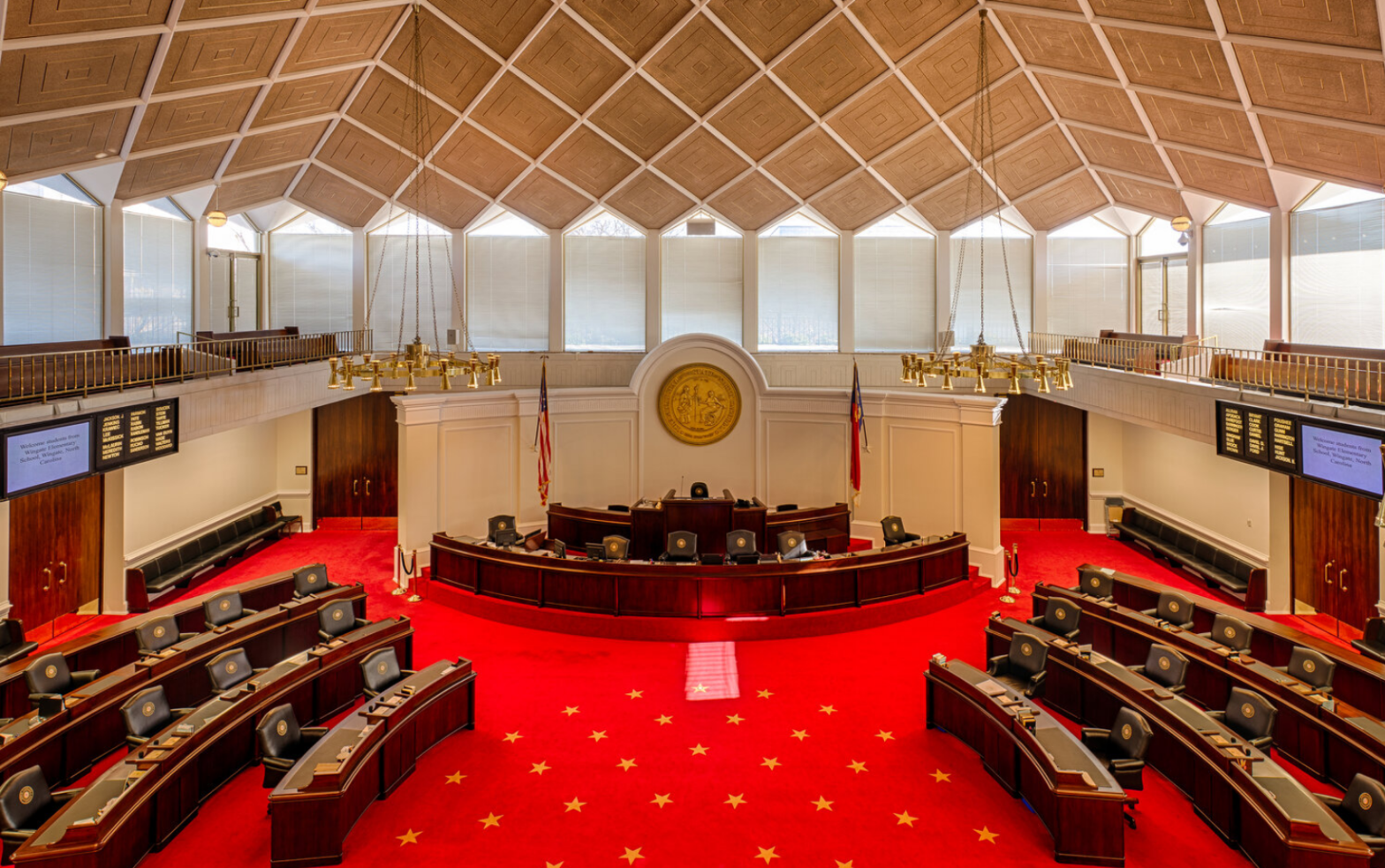

NC REALTORS® Government Affairs Update