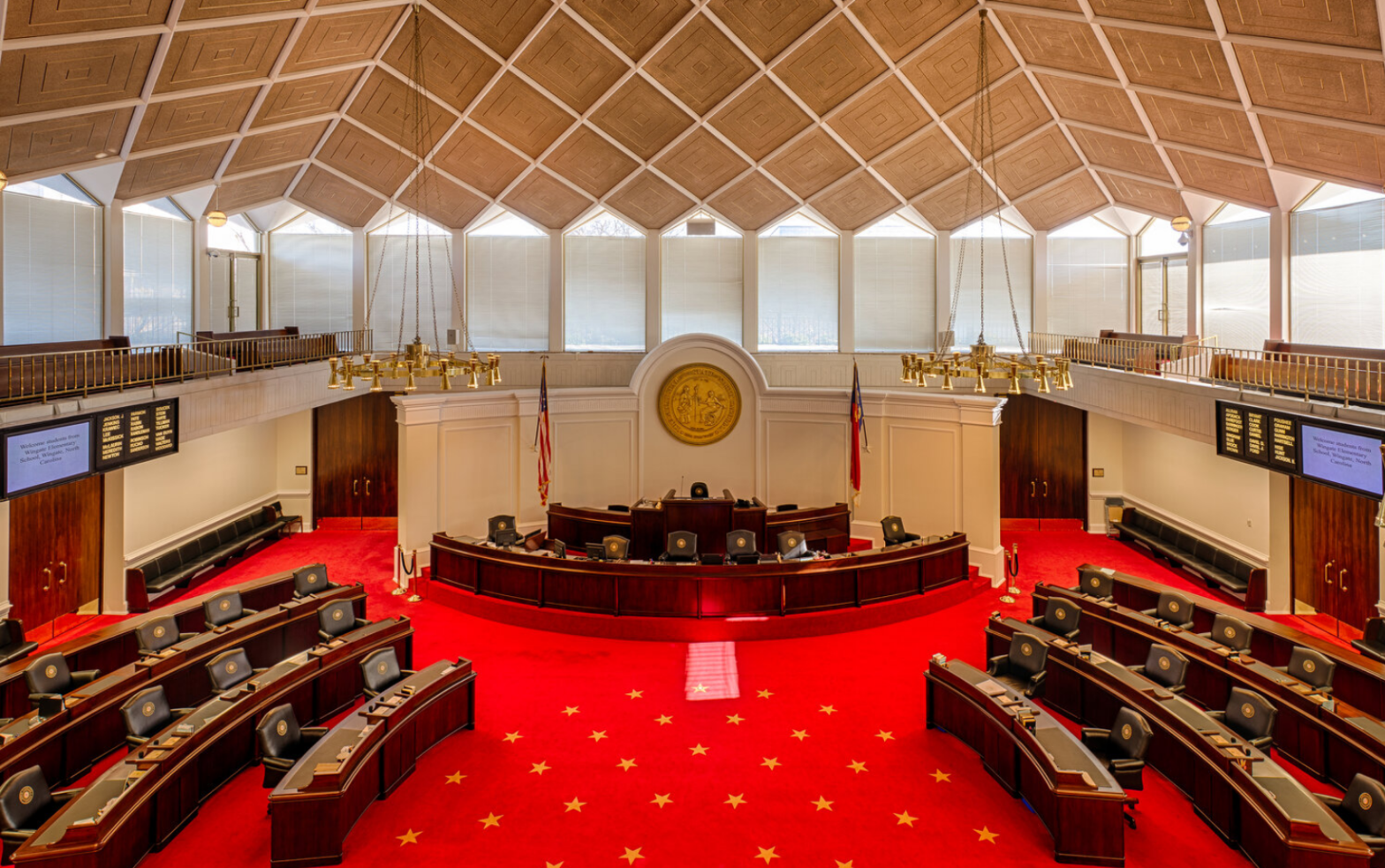

Below is a brief recap of legislative wins for the 2023 from the NC General Assembly.

State Budget Provisions:

Repeal of the privilege license tax on professionals. Starting in 2025, NCR members will no longer be required to obtain a statewide license for the privilege of practicing their profession. The tax DOES NEED TO BE PAID in 2024.

Funding for Workforce Housing Loan Program – $35,000,000 in nonrecurring funds for fiscal year 2023-2024 and the same amount for 2024-2025.

Funding for Housing Trust Fund to provide housing for homeless veterans 2024-2025 – $5,000,000

Other Legislation:

SB 452 – raises beach plan policy limits. Increases the insurable value of habitational property from $750,000 to $1,000,000. Increase the insurable value of commercial property from $3,000,000 to $4,000,000. (due to rising cost of property prices)

HB 600 – provisions to delay the implementation of the Practical Applications of Real Estate Appraisals (PAREA) until December 31, 2025. NCR’s Appraisal Section Board will need to assess the effectiveness of the new national virtual training program before NC allows the use of PAREA

HB 422 – Unfair Real Estate Agreements Act – protects homeowners from being targeted by risky real estate deals (agreement with agent and homeowner for years)

HB 190 – DHHS Bill has provisions to get more staff working on permits, this is a measure to help build more housing.

HB 627, SB 582, and SB 673 – addresses water supply issues that will more development for housing